2020 Sustainability Report

Committed to using financial, natural and human resources wisely without compromising the ability of future generations to meet their needs

Committed to using financial, natural and human resources wisely without compromising the ability of future generations to meet their needs

Committed to using financial, natural and human resources wisely without compromising the ability of future generations to meet their needs

Committed to using financial, natural and human resources wisely without compromising the ability of future generations to meet their needs

Committed to a circular economy that diverts used packaging from landfills, preserves resources and reduces use of virgin materials.

Greif actively manages the life cycle of industrial packaging through manufacturing, reconditioning, reuse and recycling to advance circular economy principles. We work with our customers, and even their customers, to produce new packages and products that build economic, environmental and social capital. Our Circular Economy management through manufacturing, reconditioning, reuse and recycling solutions helps divert waste from landfills while strengthening relationships within our supply chain. As the demand for sustainable solutions increases, our collaborative efforts with our suppliers and our customers enable us all to reach our collective sustainability goals.

We provide life cycle services through our EarthMinded Life Cycle Services (LCS) program, which leverages a network of Greif owned, joint-venture owned and other third-party owned and operated facilities in EMEA and North America, including Container Life Cycle Management LLC (CLCM), Centurion, Delta, LAF and Tholu. Participant reconditioners in the network collect used, empty, plastic and steel drums and Intermediate Bulk Containers (IBCs). Flexible Intermediate Bulk Containers (FIBCs) are recollected in EMEA through our wholly owned subsidiary, Rebu. All Earthminded LCS and CLCM operations are overseen by a General Manager who is responsible for implementing Greif’s policies, procedures, training and business objectives throughout the network and operate on many of Greif’s IT systems, including our Compliance Management System (please see the Environmental Management Systems section of our report for additional information).

Containers that are collected throughout our network are reconditioned so they are suitable for reuse and then reintroduced into trade. The reconditioned containers reduce the demand for new containers and demand for virgin raw materials, while decreasing the number of containers that go to landfill. If a container cannot be reconditioned, the materials are recycled for use into other products. Many of Greif’s largest customers use our LCS network to recondition their containers. Customers who use the network can access real-time reports through the Greif Green Tool, which enables customers to quantify performance by tracking key indicators like carbon impact and weight of reused and recycled materials. Across Global Industrial Packaging, we reconditioned, remanufactured, or recycled more than 4.5 million containers and our Paper & Packaging Services (PPS) business managed over 3.4 million metric tons of recycled paper in 2020.

Our reconditioning and reuse operations helped us remove over 70,000 metric tons of virgin steel, high-density polyethylene and wood from our supply chain in 2020.

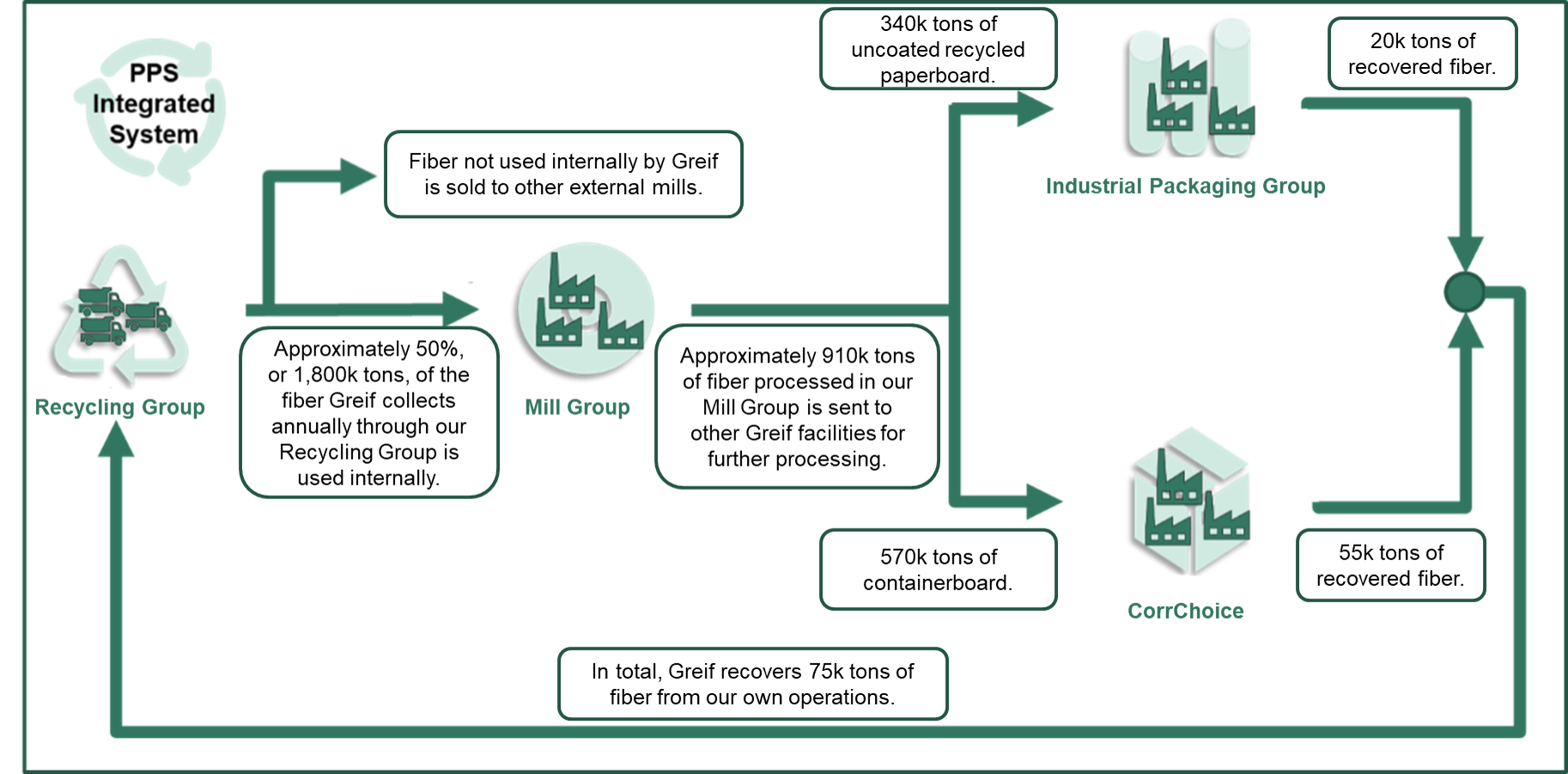

In addition to our reconditioning operations, Greif operates 18 recycling facilities in our Paper Packaging & Services (PPS) business. Through these facilities, we offer complete outsourcing solutions for plastics, pulp and paper fiber procurement, transportation and administration and provide complete paper fiber audit and management solutions. 98 percent of the products we handle, by volume, are paper fiber. Our paper fiber recycling operations collect waste paper for use in our own containerboard mills and for sale to other containerboard and recycled paper product manufacturers. Because of our integrated capabilities, Greif holds a central position in the paper recycling industry and operates as a net positive recycler. Approximately 50 percent of the fiber we collect is used in our own operations to manufacture paper products for use in consumer and industrial settings. The remaining 50 percent of the fiber we collect is sold to external mills and other manufacturing operations for use in the production of new paperboard, molded fiber packaging and other products. Over 90 percent of the fiber we use in our paper manufacturing is from purely recycled inputs.

We are proud to be able to offer services that enable the re-use of fiber. Recovered fiber is an input to many essential goods but has suffered from reductions in supply through the economic closures caused by the global COVID-19 pandemic. Prior to COVID-19, recovered fiber value was at historical lows with the cost of recovery greater than the fiber value for many recyclers. Today the critical importance of expanding access to recycling is clear, particularly as more commerce takes place at the home instead of in stores. Through our sales force and participation in various industry groups, we are doing our part to educate the market on the dynamics of the changing industry to ensure this remains a viable business with a robust supply chain for all the essential goods that depend on recovered fiber inputs.

In our Global Industrial Packaging (GIP) business, we look for reuse and recycling opportunities wherever possible. All our plastic products globally are 100 percent recyclable and 100 percent of our internal regrind plastic, which accounts for approximately 20 percent of our drums and IBCs, is reincorporated into our products. Our steel products are made from a minimum of 15 percent recycled steel globally and a minimum of 33 percent recycled steel in North America. We recycle 90 percent of our internal scrap used to produce our flexible products and the balance is sold to recycling companies. There is approximately seven percent recycled plastics (internal scrap) in our FPS plastics products.

Cradle to cradle and the use of recycled products are just two components of our circular economy strategy that span across our operations and value chain. As part of that strategy, we are working to drive circular economy principles in five key areas:

Please see the Supply Chain Management, Waste and Innovation pages of our report for more information about how our circular economy strategy spans our entire business.

In 2020, EarthMinded LCS introduced new terms for containers acceptable for reconditioning including requirements for containers that previously contained substances that can emit flammable gasses when in contact with water, requirements for all packaging to be fully closed upon acceptance, and stricter requirements for what constitutes an empty container. Collectively, these terms help us ensure our operations remain in compliance with relevant regulations and provide for better health and safety of our colleagues and those in the communities in which we operate. In 2020, Greif expanded its IBC, drum and jerrycan recollection capabilities in Italy by establishing a joint venture with LAF s.r.l., a leader in reconditioning services. In addition to reconditioning, LAF s.r.l. transforms HDPE components into raw secondary materials that are used in industry, building, furniture, and flooring.

In 2021, we will continue to expand our reconditioning services. In Spain, we will establish new joint ventures that will allow us to recondition more drums and IBCs. In our PPS business, we place greater emphasis on our fiber business to identify solutions that will be valuable to our customers and work to bring them to life.

|

|

FY 2016 |

FY 2017 |

Fy 2018

|

FY 2019

|

FY 2020

|

|---|---|---|---|---|---|

|

Recycled |

1,045,093 |

904,883 |

849,498 |

831,576 |

968,296 |

|

Steel Drums |

689,513 |

534,369 |

571,355 |

509,884 |

562,980 |

|

Poly Drums |

277,672 |

212,272 |

161,447 |

243,186 |

358,280 |

|

IBCs |

77,908 |

158,242 |

116,696 |

78,506 |

47,036 |

|

Reconditioned |

3,808,242 |

3,218,885 |

3,258,848 |

3,533,358 |

3,276,259 |

|

Steel Drums |

3,072,348 |

2,565,052 |

2,713,025 |

2,699,393 |

2,483,485 |

|

Poly Drums |

375,307 |

321,188 |

244,497 |

194,011 |

178,627 |

|

IBCs |

360,587 |

332,645 |

301,326 |

639,954 |

614,147 |

|

Total Collected |

4,853,335 |

4,136,828 |

4,105,936 |

4,348,706 |

4,164,585 |

|

Steel Drums |

3,761,861 |

3,099,633 |

3,284,380 |

3,193,049 |

2,971,549 |

|

Poly Drums |

652,979 |

535,460 |

405,944 |

437,197 |

536,281 |

|

IBCs |

438,495 |

501,735 |

415,612 |

718,460 |

656,755 |

|

Virgin Materials Saved by Reconditioning and Reuse (Metric Tons)** |

71,573 |

63,111 |

63,587 |

76,415 |

71,149 |

|

Steel |

65,743 |

56,200 |

57,664 |

66,860 |

62,016 |

|

High-Density Polyethylene |

5,830 |

5,150 |

4,243 |

5,897 |

5,553 |

|

Wood |

1,761 |

1,680 |

3,659 |

3,580 | |

|

Virgin Materials Saved by Recycling (Metric Tons)*** |

17,402 |

18,755 |

16,644 |

14,117 |

14,358 |

|

Steel |

13,288 |

13,463 |

12,697 |

10,273 |

10,215 |

|

High-Density Polyethylene |

3,817 |

4,580 |

3,385 |

3,402 |

3,871 |

|

Wood |

297 |

712 |

562 |

442 |

2720 |

|

|

FY 2016 |

FY 2017 |

Fy 2018 |

FY 2019 |

FY 2020 |

|---|---|---|---|---|---|

| Total FIBCs Collected | - | - |

316,324 |

275,732 |

242,000 |

|

Reconditioned |

- |

- |

224,418 |

179,912 |

167,000 |

|

Recycled |

- |

- |

91,906 |

95,820 |

75,000 |

|

Total Virgin Polyethylene Saved (Metric Tons) |

727.6 |

634.2

|

556.6

|

||

|

Virgin Polyethylene Saved by Reconditioning and Reuse (Metric Tons)*

|

- |

- |

516.2 |

413.8 |

384.1 |

|

Virgin Polyethylene Saved by Recycling (Metric Tons)** |

- |

- |

211.4 |

220.4 |

172.5 |